|

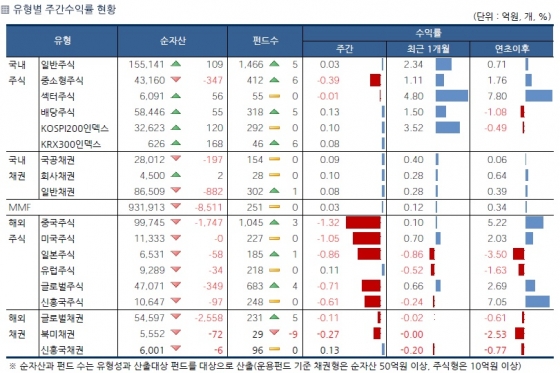

| 자료=한국펀드평가 펀드스퀘어 |

25일 한국펀드평가에 따르면 지난 22일까지(16일~22일) 국내 주식형펀드는 한 주간 평균 -0.21%의 손실을 기록했다. 이 기간 코스피 지수는 3.64% 오른 반면, 코스닥 지수는 2.11% 하락했다.

국내 주식형 펀드 중 순자산 100억원 이상 개별 펀드 중에선 '한국투자패스파인더1(주식)(A)'가 1.75%의 성과로 가장 양호한 성적을 보였다. 뒤이어 'DB신성장포커스목표전환형1(주식)'(1.29%) 'KB퇴직연금배당[자](주식)C'(1.13%) '한국투자삼성그룹적립식2(주식)(A)'(1.11%) '한국투자삼성그룹1(주식)(C1)'(1.09%) 등이 차지했다.

|

개별 국내 주식형 펀드에 한주간 유입된 자금은 최대 100억원을 넘지 못했다. '삼성마이베스트[자]1(주식)(A)'와 '트러스톤제갈공명(주식)A'에는 99억원의 자금이 유입되며 자금 유입 상위권에 들었다. '한국투자한국의제4차산업혁명[자]1(주식)(C)'(93억원) '신한BNPPTopsValue1(주식)(C-C1)'(57억원) '마이다스책임투자(주식)A1'(41억원) 등 순이었다.

반면 '한국투자삼성그룹적립식1(주식)(C1)'(428억원)이 빠져나갔다.

해외 주식형 펀드도 -0.67%로 마이너스를 기록했다. 국가별로는 베트남(2.64%) 러시아(0.99%)를 제외한 나머지가 모두 마이너스(-)를 기록했다. 인도(-1.59%) 중국(-1.32%) 브라질(-1.08%) 미국(-1.05%) 일본(-0.86%) 등이 하락했다.

|

개별 펀드로는 베트남 펀드가 수익률 상위를 휩쓸었다. '한화베트남레전드[자](주식)C-A-e'(3.47%) '미래에셋베트남[자]1(UH)(주식)C-A'(3.39%) '한국투자베트남그로스[자]UH(주식)(A)'(3.06%) 등이 3%대 수익률로 가장 좋았다. 'IBK베트남플러스아시아(주식)C-A(2.97%) '미래에셋베트남[자]1(H-USD)(주식-파생)C-A'(2.68%) 등이 뒤를 이었다.

자금은 지난 16일 설정된 '키움글로벌4차산업e-sports목표전환1(주식-재간접)A'에 255억원이 들어오며 많은 관심을 보였다. 이어 '동양차이나본토목표전환1(주혼-파생)A'(222억원) '유리베트남알파[자](주식)-C/A'(188억원) '미래에셋베트남[자]1(H-USD)(주식-파생)C-A'(120억원) 등에도 100억원 이상 자금이 들어왔다.

반면 'KB중국본토A주[자](주식)A'(118억원) 'KTB글로벌4차산업1등주(주식)C-A'(115억원) 'NH-AmundiAllset글로벌실버에이지[자](H)(주식)A'(114억원) 등에선 100억원 이상 자금이 빠졌다.

![[이수연의 TOP10] 삼성전자, 엔비디아 HBM 납품 거절 루머에 반도체 부품주 위기?](https://menu.mt.co.kr/common/etc/base_thum100x64.jpg/dims/resize/100x/optimize/)

!["학생 10명 거품 물고 쓰러져"…비극으로 끝난 '우정 여행'[뉴스속오늘]](https://thumb.mt.co.kr/10/2023/12/2023121717255330052_1.jpg/dims/resize/100x/optimize)

![영하 13도, 길냥이 죽음 막을…'얼지 않는 물그릇'[남기자의 체헐리즘]](https://thumb.mt.co.kr/10/2024/01/2024012701364573421_1.jpg/dims/resize/100x/optimize)

!["꼭 가야 해" 사람 가득 실은 배 30분 만에 침몰…292명 대참사[뉴스속오늘]](https://thumb.mt.co.kr/10/2023/10/2023100611053583558_1.jpg/dims/resize/100x/optimize)

![매니저 독단적 행동?..김호중 '운전자 바꿔치기' 의혹 미스터리 [윤성열의 참각막]](https://menu.mt.co.kr/upload/main/2024/2024051415162351321001_mainTop.jpg)

![해군 국가 미국, 파나마 독립 도운 이유 [PADO 편집장의 '미국 대 미국']](https://i2.ytimg.com/vi/UbocpYuX_xk/hqdefault.jpg)

![홍선근 회장 "격자형 구조 한미일 동맹, 동아시아 평화의 강력한 축" [2024 키플랫폼]](https://i1.ytimg.com/vi/pkVg4wXxvmM/hqdefault.jpg)

![홍선근 회장 "동맹 강화는 윈윈이 될 수 있습니다" [2024 키플랫폼]](https://i4.ytimg.com/vi/7iWOChZ79SM/hqdefault.jpg)

![광산노조 본진, 트럼프 지지 이유 [PADO 편집장의 '미국 대 미국']](https://i4.ytimg.com/vi/olBkk967o4E/hqdefault.jpg)

![트럼프vs바이든, 6개주 보면 답 나온다 [PADO 편집장의 '미국 대 미국']](https://i4.ytimg.com/vi/7kc1ddGnWtE/hqdefault.jpg)